Financial Services

Unpicking Digital Transformation: 5 themes to leapfrog the competition

10 March, 2022 | Written by: Krishnan Padmanabhan

Categorized: Financial Services

Share this post:

We had the privilege of a visit by Suresh Vishwanathan, COO TSB, to IBM’s new offices at Waterloo, London. Suresh, armed with both a wealth of business experience and a deep understanding of technical transformation, has an unparalleled track record as a pioneer of digital reinvention. From his days at Citibank where he pioneered the concept of “Bank-in-a-box” to roll out core banking across multiple countries, to his days transforming “Customer Journeys” at Barclays and now to turning around TSB, Suresh has led Digital Transformation at banks many times over and has developed a template for success. In a “fireside chat” with Prashant Jajodia, IBM’s Financial Services sector leader, Suresh shared with us the 5 key themes within his own personal template for digital transformation.

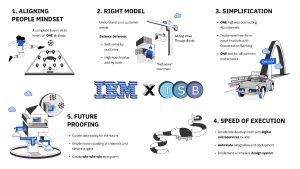

1.) Aligning People Mindset

Much like the “debate of 4-4-2 vs 4-3-3 formation in football” (one of Suresh’s many sports analogies), there is always going to be debate about strategy and tactics in Banking – about what is important and what is not. Suresh’s key message was that complete buy-in to a single strategy is required from all levels and all parties, so that the entire team can be focused on execution.

2.) Right Model

Clarity is required from the outset on the degree of customer contact required for each customer journey – from “digital self-serve” at one end, right through to “high-touch” value added services at the other end. This enables investment to be focused where maximum value can be achieved.

3.) Simplification

Simplify digital architecture: Historical and incremental change to legacy systems has created multiple “highways” connecting the system of record (core banking) to various channels. To maximise responsiveness and cost-efficiency across all channels, simplify the architecture to have one highway that connects the System of Record to all the channels.

Simplify Discoverability: A Mobile channel menu can be crowded out with icons for too many customer journeys (often 100+), making it difficult for customers to find the required functionality. An elegant way to solve this is to focus on the top journeys in the mobile app and provide access to the long tail of less-accessed functionality through a conversation banking interface that can take free-format inputs for these “intents”. Progressively these intents can be serviced automatically as straight through processing. IBM’s implementation of Conversational Banking at TSB was born out of this idea.

Simplify toolset: Different people have different opinions about various tools, distracting away from execution. This is not a space for democracy nor for freedom of choice – standardise on one set of tools that all colleagues, partners and vendors mandatorily follow and enforce it ruthlessly.

4.) Speed of Execution

Once strategy is clear it is all about the speed of execution. Avoiding technology buzzwords, it is about quickly taking an idea to the customer, which in turn is about developing and moving code quickly to production. To use another Suresh-ism, it is about “moving the pig quickly through the python”!

The IBM digital transformation team for TSB set speed of execution as the primary objective. We drove blistering pace in digital delivery by focusing on the following:

- Using pre-built capabilities out-of-the-box using IBM’s digital microservices builder to create re-usable building blocks that allowed us jointly to focus on the delivery of value-adding customer services.

- Use of automated DevOps integration and deployment pipeline.

- High level of automation of testing within the development ‘sprints’

- Implementation of a design system powered by IBM Carbon that allowed outputs of designers to be coded in a ‘component library’ that developers use to compose UI.

5.) Future proofing

The final theme was about being flexible for the future – we don’t know what the future holds but we can be prepared!

Loose coupling of a robust plumbing with various customer channels: It might be Alexa or Metaverse tomorrow that a customer uses to access the bank. As long as the servicing engine underneath is exposed as APIs it is easy to plug in any of these new channels emerge over time.

Codify customer journeys as re-usable AI intents: Create re-usable AI intents for all your customers journeys which can be consumed through any channel like chat, voice, Siri, etc.

Curate the data today: We may not be able to guess how analytics might be used 10 or 15 years from now, but what is clear is that analytics will be used for highly personalized decisions and that needs curated data. Invest today to curate data even if the end use is not apparent. The analytics can always be bolted on top.

Create ecosystems: One example is where a bank can connect the Small Business customers to each other and provide that trusted interface. This is a win-win-win, for the customer, the economy and the bank. Connecting customers and partners within ecosystems is also an incredibly powerful way to create life experiences (buying a house) rather than banking experiences (getting a mortgage).

The old world of banking is going through unprecedented degree of disruption and becoming a fast-paced technology-driven industry with high stakes. The battle is far from over, and as the industry order changes, the above ideas offer wise counsel for leaders of banks as they navigate these waters.

Partner, IBM Consulting

Preparing for the defence of the Realm

In light of current conflicts, the UK is now faced with real-world military decisions that will affect our immediate future. Ed Gillett and Col Chambers assert that industry and government must switch to a readiness mindset before the European post-war peace shatters. “My vision for the British Army is to field fifth-generation land […]

Frontier Fusion: Accelerating the Path to Net Zero with Next Generation Innovation

Delivering the world’s first fusion powerplants has long been referred to as a grand challenge – requiring international collaboration across a broad range of technical disciplines at the forefront of science and engineering. To recreate a star here on Earth requires a complex piece of engineering called a “tokamak” essentially, a “magnetic bottle”. Our […]

Safer Technology Change in the Financial Services Industry

Many thanks to Benita Kailey for their review feedback and contributions to this blog. Safe change is critical in keeping the trust of customers, protecting a bank’s brand, and maintaining compliance with regulatory requirements. The pace of change is never going to be this slow again. The pace of technology innovation, business […]