Perspectives

CFO: the restless reinventor – Chapter 3

15 October, 2019 | Written by: Rupert Clegg and Bob Booth

Categorized: Perspectives

Share this post:

Capability and culture: the key ingredients for reinvention

As we discussed in chapter 1 and chapter 2, radical new technology is uncovering valuable insights and revolutionising the way organisations operate. Any business leader worth their salt will be looking to implement these game-changing solutions. But successful CFOs will plough at least as much energy into reinventing their workforce to accommodate the new technology and drive their business into the future.

The cognitive era demands new skills from finance professionals and requires an entirely different working culture. To realise this vision, CFOs must engender a new focus, new expertise and new ways of working.

CFOs must work to develop in-demand skills in their teams, attract and retain “new-collar” millennial employees, develop a healthy human/machine work balance and establish agile, experimental practices. Not only does the CFO need to upskill and recruit workers with insight and data science skills – for both the core team and everyone connected to finance – they must also build an agile culture of failing fast and restless reinvention.

Analysis, visualisation, security, mobile, social, machine learning, data modelling… the new-collar skills demanded today would not have been likely to appear on a job description when most CFOs began their careers. But IBM research shows they are making good progress: 70% of finance leaders say they have developed analytical talent within their discipline.

But it is by no means easy. That today’s talent marketplace is competitive will not come as news to CFOs who are already set on this journey. People with the skills to implement and run data-based solutions are in high demand by all organisations. Once recruited, these organisations have to work hard to retain them or risk losing the knowledge to get value out of their clever new solutions.

Part of the challenge lies in designing a career path that is appealing to skilled millennials and experienced finance professionals alike. Because, important as the technical know-how is, traditional accountancy skills remain at the heart of the finance function; the CFO must foster a culture that bridges the gap between old-school accountants and digitally able millennials. They must be able to collaborate easily and learn from one another.

This “clustering” approach to skills, in which people who work in the field are linked to those with technical knowledge through a centre of excellence, is the key to fostering and retaining the skills the CFO needs to lead the organisation into the future, and is far more sustainable than outsourcing.

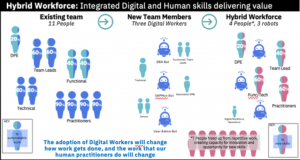

CFOs need to learn to manage a more hybrid workforce of digital workers. This is a world away from current practice, where automation is often seen as the remit of IT. Capability development must incorporate robotic, AI and augmentation skills.

As well as the technical skills we have discussed, “soft” skills such as creativity, empathy and problem-solving more important than ever. That’s because the emphasis of work within the finance function workforce is shifting to focus on higher-value services; as basic processes are automated to be executed by the “digital workforce,” the new-collar human workforce will be freed up to take on more client-centric, strategic, insight-based tasks. These roles will be more demanding, but ultimately more rewarding, too. A fine balance of technical and human skills are essential to keep pace with business change.

Importantly, CFOs must build a culture of continuous learning – not only to attract these sought-after millennial recruits but also to upskill and identify hot talent among the existing workforce. AI technology is instrumental here in recommending personalised training opportunities to employees based on their role and interests.

Finally, CFOs must reinvent the working culture within and beyond their function. They should be proactive in creating an experimental, agile, collaborative and empowered team capable of flexing to new requirements, partnering with other functions and quickly moving on from failures.

This new mindset and the implicit challenges can be a shock for finance professionals. But with eager, engaged talent in place, the CFO can set the example to the rest of the business.

As a leading technology company, IBM has been at the forefront of reskilling its own workforce and transforming its business model. IBM has had to reinvent its employee talent offerings, as below. Talk to our experts to find out how we did it.

Check back soon for the next chapter, get in touch or visit our website to find out more.

Finance Practice Leader, IBM Global Business Services, Europe

Vice President, Cognitive Process Reengineering, IBM Services Europe

Generative AI: driving a new era of HR transformation

Helen Gowler, Partner, EMEA Talent & Transformation Lead Today, I’m proud to be part of a company that’s committed to addressing gender bias in the tech industry. IBM is pioneering the use of AI to tackle this issue, and I’m excited to contribute to this effort. Our team is developing AI models that can detect […]

Multi-Modal Intelligence Platform

Traditionally, data management systems provided only numerical or textual based business intelligence primarily for back-office users across finance, sales, customer management and supply chain. Today, we are increasingly seeing data management systems which drive key business functions requiring interrogation of multi-modal data sets from documents, presentations, images, videos to audio. This demands a more sophisticated […]

The use of GenAI to Migrate and Modernise Organisational Core Programming Languages

GenAI is hugely powerful and supports a diversity of use cases by focusing on routine work – allowing people to focus time on value-add tasks, thus enhancing productivity. The focus of this use case is for an organisation which had previously focussed on a legacy set of tooling and programming languages and needed a way […]