Perspectives

CFO: the restless reinventor – Chapter 4

9 December, 2019 | Written by: Rupert Clegg and Bob Booth

Categorized: Perspectives

Share this post:

Insight is everything for the disruptive CFO

In previous chapters, we discussed the pivotal role the CFO plays in setting the agenda for decisions that can make or break the business. At the heart of this shift is the abundance of data available, and the proliferation of technology that helps us to process that data and act on the insights generated. As well as building the capability to manage and harness data, the CFO must consider the possibility for bias that can come with machine-based decision making.

Data is widely acknowledged to be the new “black gold” for business: it’s the key to the kind of agile, real-time decision making that is essential to compete in the cognitive era. It opens doors to previously unimaginable revenue sources for organisations. It allows business leaders to peek under the hood of their ecosystem to discover efficiencies and predict risks. In a world where everything is connected and customer expectations just keep on rising, any business function that doesn’t invest seriously in data analytics is destined to fail.

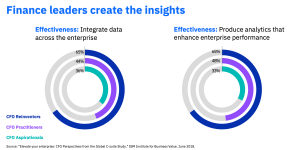

So, if CFOs are to demonstrate their value to the organisation in no other way, they must do it by curating, protecting and exploiting new sources of data to gain winning business insights. Better than anyone, finance leaders understand that data is an asset to be monetised for competitive value. Truly, data is the CFO’s not-so-secret weapon.

Finance must actively curate proprietary data – as well as public data and data from their ecosystem and partners – to drive real-time insights, develop on-the-spot forecasts and make strategic investments before rival organisations get there first. Make no mistake, speed of decision making has a powerful impact on the business; the ability to dynamically shift plans and funding brings untold advantages in a volatile marketplace.

At the start of this series, we discussed ways the CFO can grasp opportunities to own the digital space. By holding the keys to their organisation’s investment decisions, the CFO becomes the steward of data, algorithms, metrics and benchmarks. They can show leadership by putting them at the centre of the finance function: where once finance teams planned around months and quarters, today they have to make quick-fire decisions on a day-to-day basis. And they can form strategic partnerships with other functions based on shared insights.

CFOs of large companies are at an advantage in that they have more data at their fingertips than market entrants do, but the scale of it can be daunting. Organisations that prioritised investment in data-gathering over the last decade are now faced with a veritable tsunami of data – some of it structured, a lot of it unstructured. It may be tempting to turn off the tap. The real challenge now is to control, categorise and validate the data.

CFOs should invest in powerful cognitive storage and discovery engines that can analyse the data rapidly and effectively. Automated data capture, data ingestion and touchless processing through intelligent workflow and automation are key to transforming processing speed.

All the CFO’s decisions should be based on accurate and timely data and a common understanding of the facts: according to IBV research, “reinventor” CFOs create a single version of the financial truth through data. It is therefore important to invest in tools that ensure the integrity and authenticity of the data the business holds and build rigorous governance frameworks. And perhaps above all else, the CFO must invest wisely in cybersecurity controls. Blockchain plays a key role here. A single data breach could be a severe blow to the organisation’s profitability and reputation – not to mention the CFO’s credibility.

One of the biggest challenges posed by the proliferation of data is how to keep decision-making fair, auditable and bias-free across the enterprise. At the moment, readily understandable decisions can be automated – for example, mortgage application acceptance based on credit rating and other factors, but it won’t be long before more complex and sensitive decisions can be semi or fully automated. CFOs must strive to maintain transparency and balance in their decision-making processes as they become automated.

CFOs know they have to prioritise data. This knowledge may well have been causing them sleepless nights for some time. The important thing to know is they don’t have to get it all right straight away – but they do have to get started. CFOs should identify a useful and quick solution they can implement to get more out of their data and then, when they start to see results, begin to scale and plug-in extra elements.

Insight is everything. By stepping up to the challenge, getting a grip on data and becoming a custodian of insight, the CFO will cement their role as a true business partner – and the organisation will thrive.

IBM is pioneering new approaches, using AI and the data layer to drive touchless processing seamlessly across multi-ERP environments.

Through automation, IBM helped an education services client to transform its processes with the outcomes below. As is often the case, the client started along a roadmap of standardisation and automation before piloting and then adopting touchless AI-driven finance processing to enable scaling of technology and transformation of the business.

Check back soon for the next chapter, get in touch or visit our website to find out more.

Finance Practice Leader, IBM Global Business Services, Europe

Vice President, Cognitive Process Reengineering, IBM Services Europe

Generative AI: driving a new era of HR transformation

Helen Gowler, Partner, EMEA Talent & Transformation Lead Today, I’m proud to be part of a company that’s committed to addressing gender bias in the tech industry. IBM is pioneering the use of AI to tackle this issue, and I’m excited to contribute to this effort. Our team is developing AI models that can detect […]

Multi-Modal Intelligence Platform

Traditionally, data management systems provided only numerical or textual based business intelligence primarily for back-office users across finance, sales, customer management and supply chain. Today, we are increasingly seeing data management systems which drive key business functions requiring interrogation of multi-modal data sets from documents, presentations, images, videos to audio. This demands a more sophisticated […]

The use of GenAI to Migrate and Modernise Organisational Core Programming Languages

GenAI is hugely powerful and supports a diversity of use cases by focusing on routine work – allowing people to focus time on value-add tasks, thus enhancing productivity. The focus of this use case is for an organisation which had previously focussed on a legacy set of tooling and programming languages and needed a way […]