Perspectives

CFO: the restless reinventor – Chapter 1: A Brave New World

3 September, 2019 | Written by: Rupert Clegg and Bob Booth

Categorized: Perspectives

Share this post:

We stand at the starting-block for the next big shift in business. As radical new technology poses unprecedented possibilities for businesses, the CFO role is expanding in every direction.

Five years ago, the CFO’s time was dedicated to reporting, cost reduction and investor management. Today, they must adapt to the challenges and embrace the opportunities posed by this new technology and reimagine what Finance could be.

In order to drive growth within a truly disruptive business, today’s CFO is required to provide more predictive insight from ever more data and deliver agile, multifunctional decision making and real-time control monitoring. All of this, while evolving a more innovative business model and building a wholly different, technology-enabled finance capability.

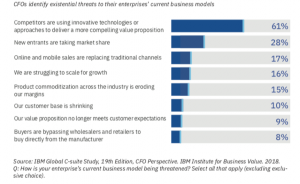

Competitors using innovative technologies are the greatest threat

According to the recent IBM Global C-suite Study, 74 percent of CFOs cite existential threats of some kind to their enterprise’s current business model. Well over half of that 74 percent say their organizations face threats from competitors using innovative technologies or approaches (see Figure 1).

Figure 1: CFOs identify existential threats to their enterprises’ current business models

Tomorrow’s business world is already here

CFOs are under pressure. Radical new technology such as automation, blockchain, cognitive and the Internet of Things are transforming their business models and those of their clients. New entrants and competitors are forcing them to defend their position as traditional boundaries blur. Their workforce is under scrutiny, with the digital and data science skills they need to face the future in high demand.

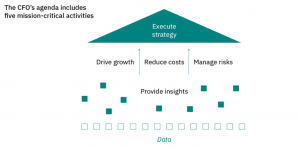

As they take on a new, expanded role alongside the CIO as brokers of digital capability, CFOs must fight to retain their territory while adopting new paradigms. They must reinvent working processes with new digital technology, harness data and analytics for better, agile decision-making, and cultivate an innovative working culture. They must do all this alongside their already-busy agendas (see figure 2)

Figure 2: CFO’s mission-critical activities

Data – the CFO’s star tool

At the heart of so many of the changes facing businesses today are data and insight. There is an explosion of information in business, and it’s overwhelming. Data is the most valuable tool in the CFO’s toolbox: it unleashes new ways to track business risk that they couldn’t have imagined in the past.

But in order to get value out of this data – either within their own business, or when providing their company’s data as a service into the market – CFOs must deploy technology and techniques that help them to store, govern and derive insights from it. Some CFOs may not fully understand this new technology, but let’s be clear: it is no longer optional. They have to adopt it or risk becoming obsolete.

Reimagine. Reskill. Reinvent

Of course, these technologies and decisions are not limited to the finance function. All functions are desperate for data-harnessing technology, and every insight has an impact on the broader business. The CFO must grasp the opportunity to be the broker of this digital capability redefining decision-making controls, taking advantage of the speed of the new technology and evolving the control environment. This will enable them to benefit from continuous controls monitoring, but also mitigate for potential risks that come with greater automation.

To achieve this, CFOs need to work with their CIO colleagues to ensure they have in place a clear, scalable and secure business and technology architecture for data, analytics, user interaction and for decision making. CFOs have to arm themselves with the ability to understand new technology and business models, the influencing skills to sell their vision to the board and the experimental mindset to walk the talk. It’s a big ask.

Crucially, they must also rapidly build the required technical capability, reinventing their current finance teams in order to get the best out of this technology. This means reskilling their existing workforce with highly covetable digital and data science skills and striving to attract and retain talent from a competitive job market.

CFOs must work to maintain their seat at the table during this time of monumental change. All departments are jostling to deliver digital innovation: by harnessing insights and remaining open to change, today’s CFO can be a catalyst for revolutionary business transformation. The successful CFO will provide leadership, set the narrative around this new technology and drive technology adoption from the board downwards.

Check now the next chapter, get in touch or visit our website to find out more.

Finance Practice Leader, IBM Global Business Services, Europe

Vice President, Cognitive Process Reengineering, IBM Services Europe

Generative AI: driving a new era of HR transformation

Helen Gowler, Partner, EMEA Talent & Transformation Lead Today, I’m proud to be part of a company that’s committed to addressing gender bias in the tech industry. IBM is pioneering the use of AI to tackle this issue, and I’m excited to contribute to this effort. Our team is developing AI models that can detect […]

Multi-Modal Intelligence Platform

Traditionally, data management systems provided only numerical or textual based business intelligence primarily for back-office users across finance, sales, customer management and supply chain. Today, we are increasingly seeing data management systems which drive key business functions requiring interrogation of multi-modal data sets from documents, presentations, images, videos to audio. This demands a more sophisticated […]

The use of GenAI to Migrate and Modernise Organisational Core Programming Languages

GenAI is hugely powerful and supports a diversity of use cases by focusing on routine work – allowing people to focus time on value-add tasks, thus enhancing productivity. The focus of this use case is for an organisation which had previously focussed on a legacy set of tooling and programming languages and needed a way […]