FinTech

New York Fed Creates FinTech Advisory Board

April 5, 2019 | Written by: Martin Fleming

Share this post:

Financial Technologies, or fintech, are having so much impact on the global consumer that financial institutions and government agencies, alike, are working aggressively to get on board.

Financial Technologies, or fintech, are having so much impact on the global consumer that financial institutions and government agencies, alike, are working aggressively to get on board.

Untethered and even empowered by such services as, Square, PayPal, Curb and Venmo, to name a few, increasing numbers of consumers have made fintech a part of their daily lives. According to its EY Fintech Adoption Index 2017, EY surveyed more than 22,000 people around the world and found that, “the average percentage of digitally active consumers using fintech services reached 33% across the 20 markets,” in that year; double the number from only two years earlier.

From traditional banking services and credit cards, to microfinancing and cryptocurrencies, fintech has become an institutional disruptor, akin to the cloud, blockchain and artificial intelligence. And as consumer confidence and adoption continue to rise, so too is the interest of financial institutions and agencies.

Today, development teams at the largest banks around the world are using fintech in the backbone of their operations, from reinventing credit allocation, to deploying blockchain and tokens in payment systems, and using machine learning for evaluating regulation. And, increasingly, a cohort of newcomers is intent on disrupting traditional financial service providers, including for mobile payments, money transfers, loans, fundraising and asset management.

Financial institutions, large and small, as well as the central banks and government agencies that regulate those financial institutions, are all looking to deepen their understanding of fintech.

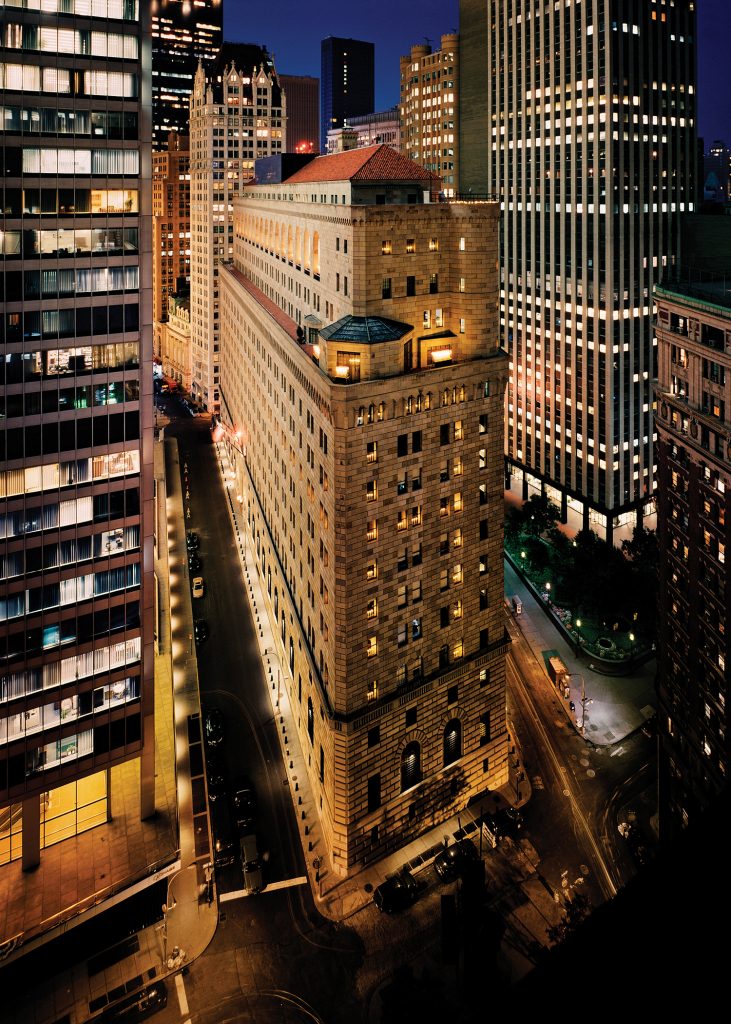

This led the Federal Reserve Bank of New York to create its first ever Fintech Advisory Group, of which I am a member. The primary purpose of the Group is to provide the NY Fed’s senior leaders an understanding of fintech’s potential, how it is currently being used, as well as how it could be used in the future.

To do it, the Group is tasked with aiding the NY Fed in the development of a more complete picture of existing and emerging technologies, the application and market impact of these technologies, and the resulting impact on the financial system. The group met for the first time this week.

IBM has always believed in the value of leading with innovation. And having been a staunch partner and supporter of so many financial institutions over the years, we are eager to help the NY Fed, an institution serving our home state, accelerate its understanding and adoption of the latest in fintech.

Chief Analytics Officer and Chief Economist, IBM

A New Wave: Transforming Our Understanding of Ocean Health

Humans have been plying the seas throughout history. But it wasn’t until the late 19th century that we began to truly study the ocean itself. An expedition in 1872 to 1876, by the Challenger, a converted Royal Navy gunship, traveled nearly 70,000 nautical miles and catalogued over 4,000 previously unknown species, building the foundations for modern […]

Igniting the Dynamic Workforce in Your Company

In the rapid push to moving to remote work, we’ve seen digital strategies accelerate by years – transforming their workplaces, workstyles, and business processes forever. Overnight, remote workforces put advanced environments of multi-device mobility, dynamic connection points and robust cloud-based apps that ease communication and collaboration. A new normal is emerging, led by the companies aggressively adopting cloud […]

Lessons from Space May Help Care for Those Living Through Social Isolation on Earth

Since the Crew Dragon spacecraft arrived at the International Space Station (ISS) on May 31, NASA astronauts Bob Behnken and Doug Hurley have been busy—according to their Twitter posts, even working over the weekend to repair the ISS treadmill. They likely don’t have much time to think about being lonely and cut off from life […]