.

Trade Finance Workflow Automation using AI

May 5, 2021 | Written by: Kiran Challapalli

Categorized: . | Artificial Intelligence | Automation

Share this post:

What Is Trade Finance?

“Trade finance represents the financial instruments and products that are used by companies to facilitate trade and commerce.

The function of trade finance is to introduce a third-party to transactions to remove the payment risk and the supply risk. Trade finance provides the seller with receivables or payment according to the agreement while the buyer might be extended credit to fulfil the trade order.”

– Investopedia.com

Why Automate the Trade Finance Workflow?

Typically for Banks, Trade Finance (TF) constitutes about 40% of their annual revenue; which is pretty significant. It is not uncommon for the Banks to have thousands of people manually processing thousands of trade documents associated with each deal. A large bank in Asia Pacific has 3,500 people manually processing trade documents. Every day in banking institutions around the globe, Trade Finance organizations struggle to process the associated paperwork with a trade. With such large investments/spends, any increase in efficiency can produce a competitive advantage and HUGE savings to the Bank. Not only that, with a more efficient processes for managing Trade Finance, Banks have a capability to market to the field, driving NEW business.

As the world becomes smaller and international trade increases, the problem becomes greater. These organizations hire and train more knowledge workers to address the increase workload – a solution that doesn’t scale long term to meet the market demand. There is a need for a smarter solution. An Artificial Intelligence (AI) powered solution can be exactly that!

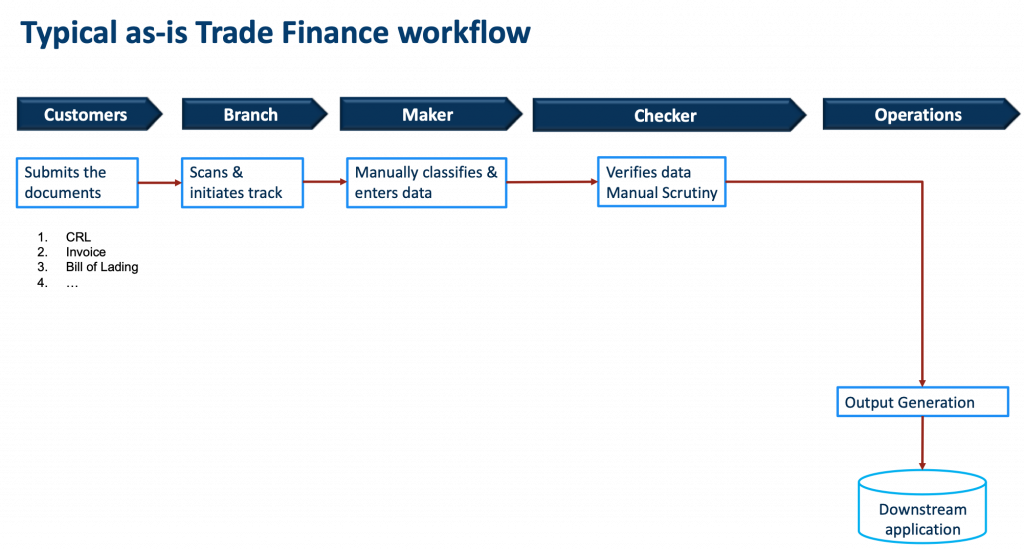

The traditional flow in a trade finance “workflow” is as follows:

- Customers submit the application at a Bank branch; with the attached physical documents. The documents vary depending on type of product. Eg: Direct Import might need bill of lading, invoice, request letter, etc.

- The branch personnel manually do a preliminary check and if anything is missing/not clear, ask the customer to furnish the same. Once all in place, the branch does a scan of the documents into PDF/image files; and sends to the TF operations team.

- At the operations, a “maker” will manually go through the documents and enters the relevant data into the system. If something is missing s/he returns the application to the branch.

- A “checker” will validate there are no errors. Again, if something is missing s/he returns the application to the branch.

- Scrutiny checks happen to ensure the application falls within the allowed rules like name validation across documents, etc.; else returns/rejects the application.

- If all goes well, then it is processed and the deal goes through

As you can see, there are multiple manual steps that could

- Slow down the time taken to process the application

- Be error prone

- Be inconsistent as every operations personnel need not follow the process to the dot

How to automate the workflow?

The scope for automation is there in every step. And, to some extent a few of the banks have already started the journey. Below I am listing all the steps that I have seen to add tremendous value.

1. Document Digitization

The most common one is using document digitization using OCR (Optical Character Recognition) to convert text in image to digitally readable text.

While this is a good first step, there are some complications. Like if the branch doesn’t scan the documents in a pre-defined order. How to know which of the pages refer to an invoice vs bill of lading? This is a document classification problem. This can be achieved with a rules or machine learning (ML) model based approach by looking at the text and determining (or classifying) the document as of a particular type.

2. Document Classification

When documents are scanned into the workflow, these could be done in batches or the order need not be consistent. By having the system classify the documents, it adds another layer of automation to the workflow, making it easier for the maker to process them.

3. Data Extraction

This still doesn’t eliminate the need for “makers” to manually enter the data; albeit the effort marginally goes down because s/he can now copy and paste the values into the TF application. But, what if you could have a system that could do the values extraction on its own without needing the Maker to do all the hard work? Natural Language Processing (NLP) comes into play here to enable this capability of extracting specific values from the semi and unstructured text.

4. Scrutiny checks automation using ML

Considering the value of the TF deals, it is imperative for Banks to do a number of scrutiny checks –like name validation across documents, anti-money laundering checks, etc. These can be further automated using rules and AI/ML mechanisms.

This, i.e. executing various Red Flag Indicators (RFI) and Scrutiny checks, can be automated using leveraging Machine Learning based on historical data and user feedback.

5. Interactive Interface (for the customers)

Another aspect of automation, which is becoming very critical in a post-pandemic world, is replacing the branch as the conduit to the Trade Finance application process. A number of banks have started providing digital portals for clients to submit applications virtually. While this has served the purpose of taking out the branch being a bottleneck (typically many back & forth interactions are required between bank & customer before the application is complete); it has mostly moved the bottleneck to the operations. What is required is the ability to build intelligence into the digital to be able to

- do the evaluation/checks and comparison to avoid time lost in multiple back & forth interactions

- interact with the client in a human-like conversational manner to guide the customer to get the application submitted properly

- possibly extend the channels to others like email, WhatsApp, etc.

With these 5 areas of automation, a bank can transform their Trade Finance workflows. And, it doesn’t have to be only restricted to Trade Finance; as other business areas (like loans processing, etc) with similar document workflows can also use the same automation platform.

Trade Finance Workflow Automation powered by IBM

IBM has an integrated solution that is built using IBM Cloud® Paks. Cloud Paks are AI-powered software for hybrid cloud that can help you fully implement intelligent workflows in your business to accelerate digital transformation. These IBM Cloud Paks tap into the power of IBM Watson® to apply AI to your business to predict and shape future outcomes, automate complex processes, optimize your employees’ time and create more meaningful and secure customer experiences.

“Cloud” doesn’t necessarily have to be public cloud. Rather the essence of what makes a public cloud like high scalability, optimal resource utilization, improved collaboration and high reliability. The Cloud Pak solutions are built on those cloud principles and can help organizations advance digital transformation with data insights, prediction, security, automation and modernization, across any cloud environment.

The Trade Finance workflow automation can be built using cloud native platform offerings from IBM – Cloud Pak for Business Automation (Datacap OCR engine and Datacap Content Classification) and Cloud Pak for Data (Watson Discovery, Watson Assistant and Watson Studio). The details are as follows:

- Document digitzation: IBM Datacap is a complete solution for document and data capture & processing solution for digitizing the documents, performs OCR on the document pages and generates the layout file for the documents with data and positional coordinates.

- Document Classification: IBM Datacap Content Classification (ICC) builds knowledge base from the extracted text on the documents and classify the documents based on the contents. The decision plan runs on top of the knowledge base to classify incoming document types based on the existing knowledge base.

- Data extraction: IBM Watson platform helps democratize by taking out the necessity to need deeply skilled NLP engineers. IBM Watson Discovery is an AI powered insights engine that has deep NLP and NLU capabilities like entity extraction, sentiment analysis, etc. and has a business friendly interface to use to extract content from documents. It comes with support for no-code annotation of free-flowing/unstructured text data using Machine Learning based and Rule based annotation technics which gives great flexibility for the solutioning team to choose right approach based on nature of data.

- Scrutiny checks: IBM Watson Studio allows users of all skill levels to be able to use it to build scrutiny checks using machine learning libraries. It has ability to create a model without any coding and integrates with Watson APIs making it easier for citizen data scientists to build ML models without much programming skills.

- Interactive interface: IBM Watson Assistant is an AI powered conversational engine that lets you build, train, and deploy conversational interactions into any application, device, or channel. Watson Assistant can be deployed in any cloud or on-premises environment – meaning smarter AI is finally available wherever you need it.

Below is the summarized representation of an automated Trade Finance workflow using the various IBM components and available as a single combined end-to-end solution.

If you want to know more, you can write to me. Even otherwise, please do tell me your thoughts below!

Connect with IBM SMEs on LinkedIn:

Kiran Challapalli – LinkedIn

Insurance Company Brings Predictability into Sales Processes with AI

Generally speaking, sales drives everything else in the business – so, it's a no-brainer that the ability to accurately predict sales is very important for any business. It helps companies better predict and plan for demand throughout the year and enables executives to make wiser business decisions.

Never miss an incident with an application-centric AIOps platform

Applications are bound to face occasional outages and performance issues, making the job of IT Ops all the more critical. Here is where AIOps simplifies the resolution of issues, even proactively, before it leads to a loss in revenue or customers.

How ICICI Prudential Life Insurance is Scaling Customer Care and Leveraging AI to Personalize Experiences

Organisations are constantly challenged to meet dynamic customer requirements and rethink ways to engage with them on their terms and as per their convenience. With customers at the core of decision making and business success, organisations are tuning to digital capabilities that can support new-age services. When done well, after sales service boosts the overall customer experience by providing […]