Digital Reinvention

PLATFORMification- A Business Model for Insurance Industry: Surviving & Thriving in Exponentially Changing Technology Eco-system

November 23, 2017 | Written by: Pankaj Singh

Categorized: Digital Reinvention

Share this post:

Current Challenges:

Most of the Insurance Companies are experiencing disruption coming from startup InsurTechs who are leveraging modern digital technologies of Mobile, Cloud, AI/Cognitive, Blockchain, IOT etc., to deliver an exceptional customer experience.

Whereas, insurance companies are struggling to match the customer experience being delivered by InsurTech. Why?

- One reason is legacy IT infrastructure.

- But the bigger reason is legacy business model which is product-centric. It is due to this legacy business model, many of the digital transformation initiatives are failing in the industry. Within the framework of legacy product-centric business model, the same agent-oriented products are put onto a Web Portal / Mobile App. Whereas InsurTech design for experience around customer’s Life-Style. Embedding insurance products / services is just incidental in InsurTech’s business model and mind-set!

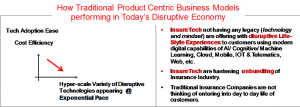

When a traditional Insurance company tries to deliver an experience that typically is provided by a InsurTech, they try to introduce modern technologies in their legacy IT landscape – only to find difficulties in adoption. More they try to introduce modern technologies; the more difficult & less efficient it becomes; as depicted by the diagram below:

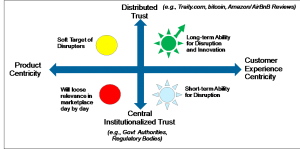

The other trend induced by modern digital technologies is DECENTRALIZATION of TRUST. As of now government appointed few authorities publish your credit score. Slowly, trust will move to multiple individuals, institutions, social influencers. Look at the popularity of Traity.com who publishes your Reputation Score’ based on social media analytics, your personality analysis, awards, key links, most relevant pictures, and “The star” ratings you have earned on sites like eBay, AirBnB, etc. Likes of Twitter, Traity.com will become institutions of trust. As of now, a small shop-keeper operating on cash transactions does not get a home loan because the way current centralized system of trust operates. But soon, such part of population, which is huge in number, will start getting acknowledged from likes of Traity.com, eBay, AirBnB, Amazon, UBER, OLA, etc. Blockchain will be used for tracking almost anything and everything: From food items, to fashion garments to diamond to property. The diagram below depicts the four types of enterprises based on dimension of Trust and Product. The enterprises that remain product centric will lose market relevance sooner or later.

How to overcome the Current Challenges:

PLATFORMification is the answer. It is a disruptive Business Model of creating a hyper-scale collaboration of the Insurance Company with the eco-system players. For each stage of customer-life-cycle, the Insurance Company identifies one or more partners capable of delivering ‘Wow Experience’.

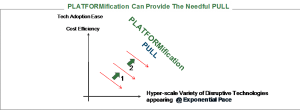

The PLATFORMification is a paradigm of extracting value out of exponential pace of technology changes adopted by eco-system players. It provides a Plu-n-Play Technology Framework & toolkit of introducing disruptive technologies coming on the horizon every day. As depicted in the diagram below, the PLATFORMification provides the needful PULL for ease of adoption of newer technologies with cost efficiencies:

As depicted in the diagram above, the PLATFORMification Pull has two constituent forces in the Insurance Value Chain:

- PULL to bring paradigm shift in Demand Creation Capabilities of the Insurance company. i.e., delivering vow experience in all stages of customer life-cycle.

- PULL to bring paradigm shift in Supply Side Capabilities of the Insurance company to become disruptive rather than getting disrupted. I.e., ability to differentiate products offerings & customer care.

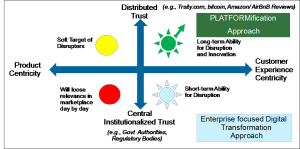

The PLATFORMification is about leveraging the innovation existing in the eco-system. It enables you to bring in the good job eco-system players have done onto your platform for your prospects / customers. PLATFORMification is like Lego building blocks using which you can make any shape. The diagram below depicts enterprises with ‘PLATFORMification’ approach focus on delivering WOW Experience to their customers with ability to trust wider spectrum of mechanisms.

PLATFORMification Success Story:

India Stack is an example of success story. India Stack is the key technology platform that is taking India into a cashless economy path. As depicted in the diagram below, India Stack has multiple layers. The Aadhaar card is the foundational layer for services provided by e-KYC and e-Sign.

Reliance Jio is able to provide customers with sims in under five minutes, a process that took anywhere between three to five days. This is a better experience for the customer.

Business Imperatives for PLATFORMification:

The PLATFORMification would need following business changes:

- Shift in Business Model: Shift from ‘Product-Centricity’ to ‘Customer WOW Experience’.

- Change in Organization Culture for adopting Startup culture where failures are welcome and mistakes are allowed.

- Innovation Guiding Framework: “FIRST PRINCIPLE”. A first principle is a basic assumption that cannot be deduced any further. Over two thousand years ago, Aristotle defined a first principle as “the first basis from which a thing is known.”. First principles thinking, which is sometimes called reasoning from first principles, is one of the most effective strategies you can employ for breaking down complicated problems and generating original solutions. We are recommending this to move away from agent centric insurance products. Now we need to design products that get used in delivering experience to the customer.

- Become ready to re-engineer business processes and product specifications: “FIRST PRINCIPLE”.

Business Imperatives for PLATFORMification:

The PLATFORMification would need following IT changes:

- Architecture Style: Hourglass Architecture and Micro-services Architecture Style. microservice architecture is a method of developing software applications as a suite of independently deployable, small, modular services in which each service runs a unique process and communicates through a well-defined, lightweight mechanism to serve a business goal. Hourglass Architecture is to identify vertical stacks developed specifically for collaboration areas like Financial Advice, Product Comparison, Search, Under-writing, Claim Management, etc. Each Stack can have its own layer of engagement, sales, service, etc.

- Implementation methodology and tools: “12 Factor App”. It deploys apps on to modern cloud platforms (IBM BlueMix, Google cloud, Heroku, AWS etc..) or Enterprise Private / Hybrid Cloud (IBM ICP). It minimizes divergence between deployment and production. Scale up without much changes in the architecture, tools or practices.

- Choose Differentiating Emerging Technologies: Depending upon your use cases, you need to choose AI / Cognitive / Machine Learning, Realtime Stream Processing, modern User Interfaces Development Platforms, Blockchain etc.

Are you ready for Digital Reinvention? Contact IBM Digital SME Now!

The solutions practice draws on the expertise of more than 2,000 consulting professionals spanning machine learning, advanced analytics, and data science, all supported by specialists with deep industry understanding. Know more about IBM Digital capabilities

References:

- India Stack: Thoughts on Unleashing the Potential of Digital India

http://indiastack.org/india-stack-thoughts-unleashing-potential-digital-india/

- Study Shows How the Internet’s Architecture Got its Hourglass Shape

http://www.rh.gatech.edu/news/69297/study-shows-how-internets-architecture-got-its-hourglass-shape

First Principles: Elon Musk on the Power of Thinking for Yourself

- Article by Rachel Botsman published in weforum.org: “The year is 20130, trust has gone digital. How do you score?”

*** End of Document ***

Practice Leader-Complex SI & Architecture Global Business Services

Logistics Operations Management ERP on AWS Cloud

Logistics operations is an essential part of the supply chain and refers to the process of moving finished goods, starting from the manufacturer, and moving to the end user.

How ICICI Prudential Life Insurance is Scaling Customer Care and Leveraging AI to Personalize Experiences

Organisations are constantly challenged to meet dynamic customer requirements and rethink ways to engage with them on their terms and as per their convenience. With customers at the core of decision making and business success, organisations are tuning to digital capabilities that can support new-age services. When done well, after sales service boosts the overall customer experience by providing […]

Genpact undergoes cyber defense transformation with IBM Security

Genpact, a global professional services firm, is accelerating digital-led innovation and digitally-enabled intelligent operations for its clients – many of them Global Fortune 500 companies – to deliver real-world transformation at scale. With oversees global operations in 30 countries serving over 800 clients, Genpact’s 90,000+ employees are reinventing business models and running thousands of processes, […]