Digital Reinvention

How Banks Can Remain Innovative on Continuous Basis in the Digital / AI Era

November 23, 2017 | Written by: Pankaj Singh

Categorized: Digital Reinvention

Share this post:

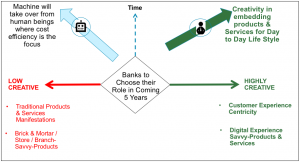

With technological advancements in Digital and Artificial Intelligence, in coming few years, human beings will get back to their intrinsic nature- ability to apply human wisdom and creativity. Most of the tasks based on mathematics and memory will be delegated to machines.

In Banks, more than 50% of the operations related to regulatory compliance, loan processing, fraud detection are the top candidates to be delegated to artificial-intelligence-powered machines. These AI powered machines will be capable of providing contextual and personalised interactions when engaging with the customer- that too at huge scale! They will be always aware of the spending and investment pattern of the customer. They will be predicting kind of financial needs of the customer- knowing very well that the daughter will goto university education next year.

Soon Amazon Alexa or IBM Watson powered voice capabilities in mobile app/web portals/ IOT Wearables will start delivering consumer-experience use cases where bank’s products will be used like a utility in the background. Customers will give voice command to Watson powered app to plan a dinner. Reservation of a suitable restaurant and UBER will happen in the background. Customers will enjoy the dinner and credit card will get used in background as a utility! Credit card usage will not come to explicit attention of the customer during the entire experience and will cease to remain an active player in customer facing role.

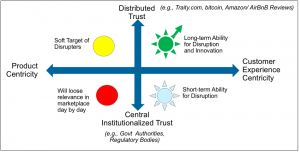

The other trend induced by modern digital technologies is DECENTRALIZATION of TRUST. As of now government appointed authorities publish your credit score. Slowly, trust will move to multiple individuals, institutions, social influencers. Look at the popularity of Traity.com who publishes your Reputation Score’ based on social media analytics, your personality analysis, awards, key links, most relevant pictures, and “The star” ratings you have earned on sites like eBay, AirBnB, etc. Likes of Twitter, Traity.com will become institutions of trust. As of now, a small shop-keeper operating on cash transactions does not get a home loan because the way current centralized system of trust operates. But soon, such part of population, which is huge in number, will start getting acknowledged from likes of Traity.com, eBay, AirBnB, Amazon, UBER, OLA, etc. Blockchain will be used for tracking almost anything and everything: From food items, to fashion garments to diamond to property. The diagram below depicts the four types of enterprises based on dimension of Trust and Product. The enterprises that remain product centric will lose market relevance sooner or later.

The Banks need to choose their role in the eco-system for coming 5 years.

In such a scenario where customer-experience-delivery gets prominence and bank’s traditional products get relegated to utility levels, the banks and its staff would need to reinvent themselves. They would need to dig into their innermost core and manifest creativity to redesign their products and services for customer-experience-led scenarios. Shift from ‘product’ to ‘experience’ will help banks and their staff survive and thrive. This would need invocation of human creativity. This cannot be delegated to artificial-intelligence-powered machine.

Are you ready for Digital Reinvention? Contact IBM Digital SME Now!

The solutions practice draws on the expertise of more than 2,000 consulting professionals spanning machine learning, advanced analytics, and data science, all supported by specialists with deep industry understanding. Know more about IBM Digital capabilities

References:

- India Stack: Thoughts on Unleashing the Potential of Digital India

http://indiastack.org/india-stack-thoughts-unleashing-potential-digital-india/

- Article by Rachel Botsman published in weforum.org: “The year is 20130, trust has gone digital. How do you score?”

*** End of Document ***

Practice Leader-Complex SI & Architecture Global Business Services

Logistics Operations Management ERP on AWS Cloud

Logistics operations is an essential part of the supply chain and refers to the process of moving finished goods, starting from the manufacturer, and moving to the end user.

How ICICI Prudential Life Insurance is Scaling Customer Care and Leveraging AI to Personalize Experiences

Organisations are constantly challenged to meet dynamic customer requirements and rethink ways to engage with them on their terms and as per their convenience. With customers at the core of decision making and business success, organisations are tuning to digital capabilities that can support new-age services. When done well, after sales service boosts the overall customer experience by providing […]

Genpact undergoes cyber defense transformation with IBM Security

Genpact, a global professional services firm, is accelerating digital-led innovation and digitally-enabled intelligent operations for its clients – many of them Global Fortune 500 companies – to deliver real-world transformation at scale. With oversees global operations in 30 countries serving over 800 clients, Genpact’s 90,000+ employees are reinventing business models and running thousands of processes, […]